Blockchain-Powered KYC Module

Revolutionizing KYC Processes with Blockchain Technology. (In Beta now and is only available for private deployment)

Transform KYC with Blockchain Innovation

The Blockchain-Powered KYC Module of the BCube RegStacker Platform integrates blockchain technology to optimize Know Your Customer (KYC) processes. It leverages distributed ledger technology (DLT) and smart contracts to automate compliance tasks, enhance security, and ensure transparency in KYC workflows.

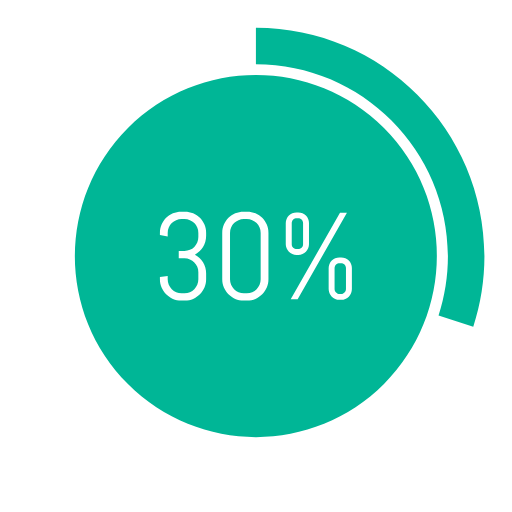

Inefficiencies in Traditional KYC

Approximately 30% of compliance resources are spent on repetitive manual checks, leading to delays and errors. Blockchain streamlines this by providing secure, tamper-proof records.

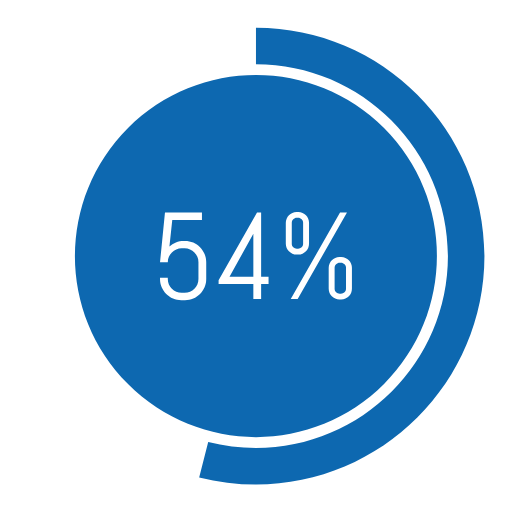

Adoption Trend

In 2023, 54% of financial institutions reported investing in blockchain-based solutions for KYC and compliance, signaling a major shift toward digital transformation.

Key Features

Streamlining KYC Processes with BCube RegStacker

Decentralized KYC Data Storage

.png)

Smart Contracts for KYC Automation

Seamless Integration

Enhanced Security and Privacy

Immutable Audit Trails

Benefits for Your Organization

Enhance KYC Processes with Blockchain-Powered Automation

Efficiency Boost

Automate manual KYC processes, reducing time and costs while improving accuracy.

Enhanced Transparency

Blockchain’s immutable ledger ensures that all KYC activities are auditable, fostering trust and accountability.

Future-Ready Compliance

Adopt blockchain technology to stay ahead in an increasingly regulated environment.

Use Cases

BCube Analytics: Transforming KYC Across Industries

Financial Services Onboarding

Vendor and Partner Verification

Cross-Organization Data Sharing

Regulatory Reporting